|

A member of a Chinese business delegation speaks with an employee (R) of Israeli high-tech firmironSource at his office in Tel Aviv in this file photo. [Photo/Reuters] |

Avi Cohen, CEO of The Floor, a Tel Aviv-based incubator of financial technology firms,hosts visitors, mostly Israel entrepreneurs, all the time. But, on a recent Septemberweekend, his guests were 30 chairpersons of Chinese firms.

"Traditionally, Israeli entrepreneurs tend to look at Western markets for growth. But that ischanging with the growing interest from Chinese investors," Cohen said.

The Floor was established eight months ago. So far, it has raised $2 million from PandoGroup, a venture capital fund backed by China's Bloomage BioTechnology Corp Ltd. TheFloor plans to open a Shanghai branch next year.

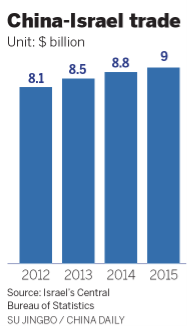

The investment is part of a broad trend unfolding in Israel, a global innovation hotspot whichhas become a popular destination for Chinese capital as China works hard to upgrade froma manufacturing hub into a tech beehive.

"Currently, every week, there is a Chinese delegation visiting Israel. They can beentrepreneurs, scholars or government officials," an official at the Chinese Embassy in TelAviv told China Daily.

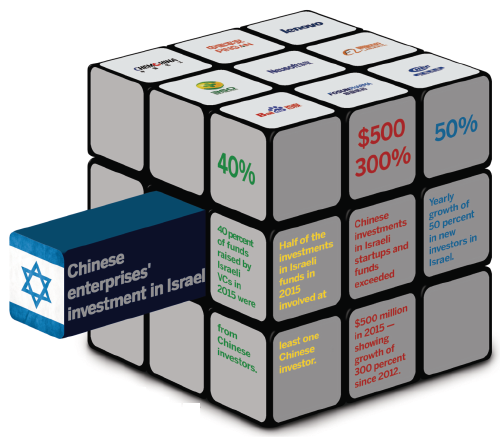

In 2015, Chinese investments in Israeli startups and funds exceeded $500 million, showinga growth of 300 percent since 2012, data from the Israeli Ministry of Economy and Industryshows.

Tech giants such as Baidu Inc and Alibaba Group Holding Ltd, as well as players intraditional industries, have all joined the race. Last year, Chinese firms contributed 40percent of money raised by Israeli venture capital funds.

"Israel's tech scene is a can't-miss these days," said Song Chunyu, vice-president ofBeijing-based Lenovo Group Ltd. In charge of Lenovo's investment unit, Song visits Israel atleast once a year.

According to him, the Middle Eastern country, which was ranked by Bloomberg as thesecond most innovative country in terms of R&D capabilities in the world in 2015, is highlycomplementary to China's economy.

"Israeli entrepreneurs are willing to spend years and decades on a specific core technology,but their growth is often limited by its small domestic market," Song said.

On the other hand, China, with a stable economy and a population of 1.3 billion, is a hugemarket but lacks ultra-modern technologies. "The two countries are a perfect match in thetech sector," he said.

Lenovo has so far poured $20 million into six Israeli startups, including Neura, a platformthat helps users personalize connected devices while guarding their data.

It plans to invest $100 million more in local startups over the next three years to tap intoIsraeli talents.

Hila Engelhard, an official at the Israeli Ministry of Foreign Affairs, said: "China is like a giantcomputer and Israel can serve as a processor in it."

According to her, a big portion of Chinese money is flowing into areas like agriculture,medical technology mobile internet and other high-tech industries.

Chinese industrial conglomerate Fosun International Ltd, for instance, spent $240 million toacquire a 97 percent stake in Israeli medical tech firm Alma Lasers Ltd.

Last year, Baidu Inc invested $5 million in Tonara, which developed an interactive musiceducation app, along with its Israeli VC partner Carmel Ventures. Prior to that, it invested $3million in local video capture firm Pixellot.

The trend is fueled by the national governments' efforts to deepen bilateral ties. A 10-yearmultiple entry visa policy will take effect next month. The two sides will also start talks for afree trade agreement. That will be preceded by a three-year deal to promote bilateralcooperation.

Such enthusiasm was very much in evidence at the second China-Israel Innovation andInvestment Summit, which was held in Tel Aviv in late September. About 100 Chinese firmsand 300 Israeli companies showed up and negotiated investment proposals totaling $1.5billion, according to the conference organizer.

Among them is Chinese social networking heavyweight Tencent Holdings Ltd, which islooking for startups in artificial intelligence, augmented reality and cloud computing.

A group of CEOs from 40 smaller Chinese manufacturing firms was also present, looking fortechnologies that can upgrade their factories or help build new growth engines, as theywrestle with mounting pressure of an economy whose growth rate is slowing.

Chinese IT firm Neusoft announced at the start of the conference with Israeli-Chineseprivate equity fund Infinity Group that it would jointly set up a $250-million fund to invest inIsraeli medical technologies over the next three years.

Shen Meng, director of Chanson & Co, a boutique investment bank in China, said a fewChinese startups do have "core technologies", but have been over-valued, pushing up theinvestment cost, which is prompting investors to look for the real gold in Israel.

"But China's budding businesses that are competitive won't suffer from this trend. After all,China has a lot of investable funds now. What we really lack are good ventures," Shen said.

Eran Wagner, general partner of Israeli VC fund Gemini, said Chinese firms often adopt twoapproaches to investing in Israel: they either pour money into local VC funds whose networkcan help them effectively reach early-stage startups or directly pump capital into late-stagefirms that have mature technologies and products. "Chinese investors prefer later-stagefirms."

But as China is moving rapidly from being a manufacturer to a global R&D center, theappetite for risk and willingness to fund technologies that are not fully developed, aregrowing, he said.

Compared with their Western counterparts, however, deep-pocketed Chinese firms are stillnewcomers to the Middle Eastern country. The language barrier-English and Hebrew arepredominant in Israel-cultural differences and a different startup ecosystem all add up tothe challenges that Chinese investors face.

"It is quite important to develop trustworthy local advisors to navigate the differencesbetween the two countries," said Chen Hongwei, executive director for Tencent's mergersand acquisitions.

Things are already moving in that direction rapidly. Legal firms, HR firms that supplyworkers, translators and guides, and platforms connecting Israel and China, aremushrooming.

Geekpark and 36Kr.com, two popular Chinese technology websites, rolled out Israelibusiness trip projects last month for small Chinese firms keen to visit Tel Aviv forinvestments.

Wang Xin, a Chinese student at Hebrew University, is itching to jump on the bilateral techbandwagon. "I wanna stay in Israel to help deepen China-Israel business connections upongraduation. This is an opportunity too precious to miss."